Finance research traditionally used to focus on the big players, such as industries and firms. But over the past decade, the level of data available has become so individualised that it has enabled researchers to probe into the personal behaviour and decisions of managers, households and others. To understand just how personal this data is, consider the research of Dr Wang Zigan, who has been studying the migration patterns of inventors and ‘star’ scientists.

Dr Wang has been able to access their home addresses, whether they have children at home and their ages, and other highly personal data that he has combined with more general information to predict when a scientist might move to another location.

“I want to estimate the impact of every factor that affects their decision. The scientists themselves may not fully understand what drives their move – they might just think they don’t like the place. But the machine can scan and analyse all the data and show, for example, if the decision is 35 per cent due to the surrounding environment, 25 per cent to the salary and 15 per cent to tax policies. And it can very accurately predict whether another inventor will decide to move,” he said.

Many other researchers are similarly using personal data, such as a professor at Cornell University who studied the relationship between corporate managers’ personal home mortgage debt and their firm’s debt.

Data like this is accessible to approved scholars through application to governments and in some cases purchase from private firms. The two examples cited here used Western sources, but there is an even richer trove of data in China. “Big data analysis is developing much faster in China than the United States because there are much fewer legal constraints,” Dr Wang said.

![]() My very pessimistic prediction is that

My very pessimistic prediction is that

we will be data cows, starting from

FinTech then to genome or medical technology, then to whatever follows

that. ![]()

Dr Wang Zigan

Knowing their customers

While the boost to scholarship is interesting, the real impact of the data boom is being seen in business, with consequences for consumers. For instance, “Chinese firms are accumulating more and more data and using it to study their customers’ every behaviour so they can extract more profits from them,” he said.

Alibaba’s Ant Spend Now uses algorithms to approve automatic loans to customers. The machines can process huge amounts of data very quickly – something that has only become possible in recent years because more personal data is now available – and as a result have much lower default rates than loans approved by people.

“The automatic loans are probably China’s greatest FinTech achievement,” Dr Wang said. “But is it a good thing? Providing liquidity or credit to people who really need it is good, but loans are also provided to people who do not need them, like college students. They’re given very high interest rates and forced to repay.

“And if they can’t repay? They will just have to because in China, you cannot avoid using smartphones. The apps used for calling a cab, ordering online and many other things are wholly owned by the giant technology firms that provide the loans, and they can prevent you from using those apps. So for people who do not have good self-control, automatic loans are a bad thing. They could drag a lot of people down – that is the dark side of it.”

FinTech is only the start

American technology giants are hampered by their legal system which makes it more difficult to obtain and use people’s data. Even so, there is the example of Cambridge Analytics, which was given access to data about Facebook users. Facebook has promised to tighten privacy protection, as has Google. “But how do you really know they have done what they said? Who can check the codes? Not even programmers may understand the codes fully,” he said.

The use of data will only accelerate and governments are also getting in on the act. China has minimised controls on technology firms in exchange for help in acquiring data. Dr Wang believes this will give the country an advantage in the next stage of the AI-driven revolution.

“FinTech is the first field making great progress in the big data age, the next one will be medical technology. The more data you have from people, the more accurate you will be able to know which gene or combination of genes controls which disease,” he said. This is generally a positive thing except, he added, that genes can also determine people’s emotions. If the government understands this, it could open the way to manipulating people’s moods and behaviour.

Given the value of data to businesses and governments, and the rapid developments in their ability to obtain and use data, Dr Wang sees reason to worry about the future. “My very pessimistic prediction is that we will be data cows, starting from FinTech then to genome or medical technology, then to whatever follows that. This is our future,” he said. He therefore recently threw away his smartphone, although he is struggling with how to make payments when he next visits Mainland China, where smartphone payments are often the only option.

Back

THE DATA REVOLUTION

GETS PERSONAL

Scholars, businesses and governments are benefitting from the huge amount of data available in the finance field. This is both exciting and unnerving, says Assistant Professor of Finance Dr Wang Zigan.

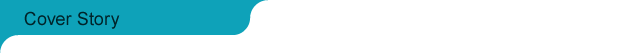

Being able to access highly personal data for analysis, Dr Wang looks into the relationship between toxic emissions and executive migration. The above figure maps the location of the 58,094 Toxic Release Inventory (TRI) plants that operated between 1996 and 2014. Each dot represents a TRI plant location.

Home

November 2018

Volume 20

No. 1