SuperCharger start-up

SuperCharger is a start-up formed in 2015 by PhD candidate Janos Barberis, with Professor Douglas Arner on the advisory board. The company rapidly developed into Asia’s top FinTech accelerator, working with regional growth-stage companies as well as international mature scale-ups wishing to enter Asia. To date, it has received over 1,000 applications and helped 46 companies through its 12-week programme that facilitates market entry via workshops, access to investors and mentors, and publicity, which now runs in Malaysia as well as Hong Kong.

The company also feeds indirectly into research, Professor Arner said. “Interacting with start-ups and the industry through SuperCharger is very important for us to understand what people are doing, what sorts of business ideas and technologies they are looking at and what issues they are running into,” he said.

The FinTech Revolution

Technology is transforming finance. HKU is at the forefront in explaining financial technology, identifying its impacts and using that knowledge to help others understand this deepening trend.

Next

The starting point

When the scholars started working on their groundbreaking paper only three years ago, there were few others in their field looking at FinTech. Mr Barberis had just started his PhD under Professor Arner’s supervision, having worked on building a new online bank in the United Kingdom. As they discussed this emerging market activity, they saw an opportunity. “We realised there was a lot of confusion. There was this new term FinTech and people were beginning to see a lot of new things happening. So we set out to explain all the major trends that were coming together to transform the way that finance was operating all over the world,” Professor Arner said.

Their first point was that the relationship between finance and technology was picking up. This was first seen in major developed markets, where US$5 trillion a day changes hands through global payment systems and people trade stocks in nano-seconds through high-frequency trading. But they also identified three other, less well-known trends.

One was the move to online finance in developing countries. Kenya became a centre for this development after it launched mobile phone-based payment services about 10 years ago and others followed suit in Africa and Asia, including China and most recently India. China in particular has undergone the most rapid financial technological transformation in history, as seen by the financial services ecosystems launched by Alibaba and Tencent that serve hundreds of millions of people.

Another trend was the involvement of start-ups, which are increasingly becoming a source of new ideas and new ways of doing things.

“Pre-2008, research and development in financial services was largely about sales – it was rarely about coming up with better ways of doing things. We’ve now had this explosion of start-ups involving both technology and financial services companies trying to come up with these better ways,” Professor Arner said.

The final trend they identified was the move of technology companies into financial services, which the scholars dubbed ‘TechFin’. This includes such companies as Alibaba, Tencent, Amazon and Facebook.

In addition to these trends, their ongoing research has been identifying the risks involved in financial technology and how these can be addressed from a policy standpoint.

RegTech and TechFin

The use of new technology to regulate the finance industry is of interest for both firms and policymakers. Firms use it to comply with regulation while regulators aim to use it to improve regulatory outcomes. RegTech itself is not very new, as Professor Arner pointed out: in the United States, the major source of insider trading prosecutions since the 1980s has come from historical stock exchange data that must be handed over to the authorities in cases of mergers and acquisitions. The trading activity is matched to a list of insiders to see if there was any unusual activity leading up to the merger or acquisition.

Hong Kong is in the process of building similar systems, with the Securities and Futures Commission tendering to build an online platform to receive company reports, which could be analysed using data analytics to monitor activities and flag problems. The Hong Kong Monetary Authority also recently issued its strategy for RegTech in the context of new virtual banking licence issuance.

Regulation becomes rather more complicated when technology companies start providing financial services – that is, in the case of TechFin. Technology companies have huge scale, distribution and customer access, which creates more systemic risk, said Mr Barberis, who is focussing on TechFin for his PhD, which will be completed by early 2019.

“With financial institutions, the whole regulatory system is built around making sure they hold capital so they don’t go bust because of a mismatch of liability and financing. But technology companies don’t have loan books and they don’t try to hold cash. They’re all about flows, not holding capital. Arguably, there is something new on the back of that observation,” he said.

FinTech as a door to financial inclusion

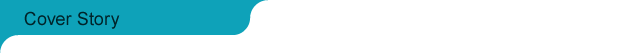

As these insights have emerged, attention has turned towards providing solutions. “There are increasing examples of industry and regulators working together to design better systems based on technology,” said Professor Arner, who has been the proponent of one such system, with Professor Buckley and Professor Dirk Zetzsche of the University of Luxembourg, that was recently adopted as policy by the Alliance for Financial Inclusion (AFI) and highlighted at the 2018 Annual Meetings of the International Monetary Fund and World Bank Group in Bali.

Drawing on their research, the scholars put forward a four-pillar strategy for improving financial inclusion and transforming digital financial systems. It includes building digital identification systems, digital payment infrastructure and open electronic payments systems; promoting the opening of accounts and access, starting with electronic payments for government services; designing digital financial markets and systems; and using regulation to support these pillars.

“Most of the 1.2 billion people who have gained access to financial services since 2011 have come from a small number of countries – Kenya, China, India, Russia. There are still 1.7 billion people who don’t have access. Banks and regulators are looking at what lessons can be drawn not just to support financial inclusion, but as a strategy for transforming their digital financial systems,” Professor Arner said. “Importantly, 70 per cent of that 1.7 billion have mobile or smart phones and this sets the stage for rapid transformation in the coming years.”

With AFI, Professors Arner, Buckley and Zetzsche are now working with a group of ASEAN [Association of Southeast Asian Nations] countries on how to implement this strategy, as well as with another group of Pacific Islands countries working on a regional approach.

Blockchain, Bitcoin and trust

One system that has Professor Arner’s attention is blockchain technology. Most people associate it with Bitcoin, but it has much wider scope than that. “We’ve spent a lot of time looking at the legal and regulatory issues around blockchain,” he said. “Blockchain is basically a record-keeping system and its core strengths are in security, transparency and permanence. If you want speed, it’s not very effective. So for securities trading, which takes place throughout the day at very high speed, blockchain doesn’t work well for that. But at the end of each trading day when you have to record who owns what, it’s very useful.”

Cryptocurrencies such as Bitcoin are basically a unit of account for pricing or valuing the things recorded on a blockchain’s ledgers. “Lots of people are interested in cryptocurrencies. Bitcoin was the first real application. Over the past year we’ve seen a massive spike in value followed by a massive collapse that has now entered the history books as one of the world’s greatest speculative bubbles. It doesn’t mean the price won’t go up again or that the underlying asset is valueless. But from my standpoint, the underlying technology of blockchain is more of interest than the cryptocurrency application,” he said. The team is currently working with the Asian Development Bank on policy issues around blockchain.

One thing Professor Arner is unwavering about is that the need for regulation of FinTech and all its permutations – not just for the consumer, but the industry. “Most FinTech start-ups want regulation because it gives a level of trust to the community, which is good for their business.It helps them compete with the traditional financial institutions. To the extent that they have a license and are regulated, it definitely increases trust,” he said.

What is FinTech? The first thing to understand is that despite the 21st-century label, financial technology (as FinTech is properly known) is not new. It has been in use for more than 2,000 years, starting with coins then paper and credit cards and, more recently, cryptocurrencies such as Bitcoin. This understanding is the starting point of a 2015 study by HKU scholars that became the most downloaded paper on FinTech on the Social Science Research Network (SSRN) and has been frequently cited by scholars and policymakers around the world.

“Our contribution has been to show not so much what FinTech is but who is using it. One hundred years ago it was used by governments. Seventy years ago, banks like Citibank and JP Morgan started to create innovations like credit cards and ATM machines. In the last 10 years, innovation in technology is being done more by start-ups than financial institutions,” said Janos Barberis, a PhD candidate in law who co-authored the paper, titled ‘The Evolution of FinTech: A New Post-Crisis Paradigm?’, with Professor Douglas Arner, Kerry Holdings Professor in Law, in the Faculty of Law and Professor Ross Buckley of the University of New South Wales, published in the Georgetown Journal of International Law.

Moreover, the rapidity of recent developments is new and it is having repercussions that reveal themselves practically in real time. New players are entering the finance industry, not only start-ups but also technology companies, such as Alibaba, Tencent and Amazon. Many new users are gaining access to financial services for the first time, including 1.2 billion users just since 2011. New technology is also changing the nature of finance, in particular blockchain which, among other things, has spawned cryptocurrencies.

Regulators are trying to catch up with all these trends, which is where the HKU scholars come in. Following their initial paper, they have produced or are in the midst of completing research on RegTech (regulatory technology), TechFin (technology companies in the finance industry) and other trends in the field; launched a start-up; produced policy papers for the Alliance for Financial Inclusion (AFI) made up of central banks and bank regulators from more than 100 developing countries; and launched Asia’s first FinTech MOOC (massive open online course), as well as undergraduate and Master’s programmes in FinTech.

“FinTech is rapidly changing the finance industry and this is of critical importance to Hong Kong given the size of the financial sector here,” Professor Arner said. “We believe there is tremendous scope to re-conceptualise global finance and its regulation in line with technological change and we have been working with industry, policymakers and regulators to move this forward.”

![]() FinTech is rapidly changing the finance industry and this is of critical importance to Hong Kong given the size of the financial sector here.

FinTech is rapidly changing the finance industry and this is of critical importance to Hong Kong given the size of the financial sector here. ![]()

Professor Douglas Arner

![]() With financial institutions, the whole regulatory system is built around making sure they hold capital so they don’t go bust because of a mismatch of liability and financing. But technology companies don’t have loan books and they don’t try to hold cash. They’re all about flows, not holding capital.

With financial institutions, the whole regulatory system is built around making sure they hold capital so they don’t go bust because of a mismatch of liability and financing. But technology companies don’t have loan books and they don’t try to hold cash. They’re all about flows, not holding capital. ![]()

Mr Janos Barberis

Professor Douglas Arner spoke at the Pan Asian Regulatory Summit in October, 2018.

(Courtesy of Refinitiv)

Janos Barberis (left) and Professor Douglas Arner (right) at a seminar on regulating FinTech innovation.

Professor Douglas Arner (first from left) at the 2018 Annual Meetings of the International Monetary Fund and World Bank Group in Bali.

(Courtesy of Alliance for Financial Inclusion)

HKU FinTech Day was held on October 29, 2018 as part of the 2018 FinTech Education Series of the Hong Kong FinTech Week.

![]() Most FinTech start-ups want regulation because it gives a level of trust to the community, which is good for their business. It helps them compete with the traditional financial institutions.

Most FinTech start-ups want regulation because it gives a level of trust to the community, which is good for their business. It helps them compete with the traditional financial institutions. ![]()

Professor Douglas Arner

MOOCs and more

The University is embracing the academic opportunities offered by its leading research in FinTech. FinTech has been named a strategic interdisciplinary research area and is the focus of new research centres being established in the Faculties of Law, Business and Economics and Engineering. Research-related MoUs [Memorandums of understanding] have also been signed with the Hong Kong Science and Technology Park and Cyberport. And a new Law, Innovation, Technology and Entrepreneurship (LITE) programme is being set up to facilitate the transfer of research into impact.

Asia’s first FinTech MOOC (massive open online course), led by Professor Arner, Mr Barberis and other scholars and industry experts, was launched on edX in the spring

(www.edx.org/course/introduction-to-fintech). It has attracted over 30,000 enrolments from every country in the world and with Standard Chartered Bank made it an element of its FinTech training programmes. The course will soon be joined by two other HKU FinTech MOOCs from the Business and Engineering Faculties to jointly form HKU’s first online professional certificate.

FinTech is also featuring in study programmes. The first students in a new Bachelor of Arts and Sciences in FinTech will start in September, 2019 and postgraduate FinTech programmes have or will soon be launched in the Faculties of Law, Business and Engineering.

Home

November 2018

Volume 20

No. 1